Our goal is to share information and products that are truly helpful to renters.

If you click on a link or buy a product from one of the partners on our site, we get paid a little bit for making the introduction. This means we might feature certain partners sooner, more frequently, or more prominently in our articles, but we’ll always make sure you have a good set of options. This is how we are able to provide you with the content and features for free. Our partners cannot pay us to guarantee favorable reviews of their products or services — and our opinions and advice are our own based on research and input from renters like you. Here is a list of our partners.

Compare car insurance quotes

How to compare free online car insurance quotes

How to compare car insurance quotes

You heard somewhere that you should compare auto insurance quotes every two years. Maybe you’re moving to a new place and realize you’ll need a new insurance provider. Nice work thinking ahead. Let’s get you prepared so you can zip in and out of this process as fast as possible.

1. Gather your information

Before you compare car insurance quotes, you’ll need to gather essential info, including details about your car and you.

- Vehicle details – Mileage, date of purchase, VIN (Vehicle Identification Number). If you are thinking about purchasing a car, snag the make, model, year, and mileage.

- Personal information – Address, date of birth, driver’s license, marital status, and occupation.

- Driving history – Violations, tickets, and completed driving courses.

2. Choose your level of car insurance

How much car insurance do you need to protect you, your passengers, and your car? There are three primary types of coverage offered by most car insurance providers: liability, collision, and comprehensive.

Liability. Liability insurance covers damages and costs you caused to another person or their vehicle due to an accident, like medical expenses or auto repairs. Typically, auto insurance providers talk about liability coverage in terms of “250/500/250”. This means:

- $250,000 of coverage for bodily injury (per person)

- $500,000 of coverage for bodily injury (per accident)

- $250,000 of coverage for property damage (per accident)

Collision coverage. No matter who is at fault, collision coverage pays to repair or replace your car if you’re in an accident with another vehicle or you run into something.

Comprehensive coverage. Whether it’s theft or damage from a fire, a storm, a natural disaster, or even a tree limb falling on your car, comprehensive coverage will pay to replace or repair your car as long as the damage isn’t due to a collision.

Extended coverage. Includes medical expense coverage, personal injury protection, guaranteed auto protection, and uninsured motorists.

3. Use a car insurance calculator to compare online auto insurance quotes

A car insurance calculator like this one from Insurify makes it easy to compare online auto insurance quotes. You provide the details about your car and level of coverage you are interested in, for example:

- Car specifics

- Levels of coverage and liability

- Deductible

- Average policy cost increases year-over-year

- Discounts you might be eligible for

And Insurify does the rest by providing you with multiple quotes based on the information you provided.

4. Ask for personalized driver discounts

Car insurance companies are often running deals and discounts so be sure to ask them about any promotions or offers that might convince you to go with them. Check out our comprehensive list of car insurance premium discounts to help you request and review the most affordable options.

Enter your zip code to see how much you can save.

(Psssst! Roost partners with Insurify and over 200 insurance companies to help you find the best quote. And, your state’s minimum car insurance requirements are pre-loaded into the options. Check it out!)

Factors that influence your car insurance quote

Auto insurance companies assess several risk factors when determining your policy quote. This helps them determine how likely you are to get in an accident or filing any number of auto-related claims (like someone trying to steal your car).

Where you live

Where you live and drive influences your car insurance premium because it indicates risks related to crime, population density, and weather. If you live in a zip code with a high accident rate, for instance, premiums will be higher.

Driving record

No surprise here — safe drivers are rewarded with a lower insurance premium. Avoid speeding and stay out of accidents, and you’ll save 5% or more on your premium. Most companies will further reduce your rate every time you go three years without a traffic violation. (Go slooowwwwer.)

Your car

The car you drive has a huge impact on your auto insurance premium. Might seem a little crazy, but the make and model indicate your likelihood of accidents, theft, and claims. (Insurance companies have oodles and oodles of data that on this kind of stuff.) Even the average cost of repairs and safety test results are calculated into your insurance quote.

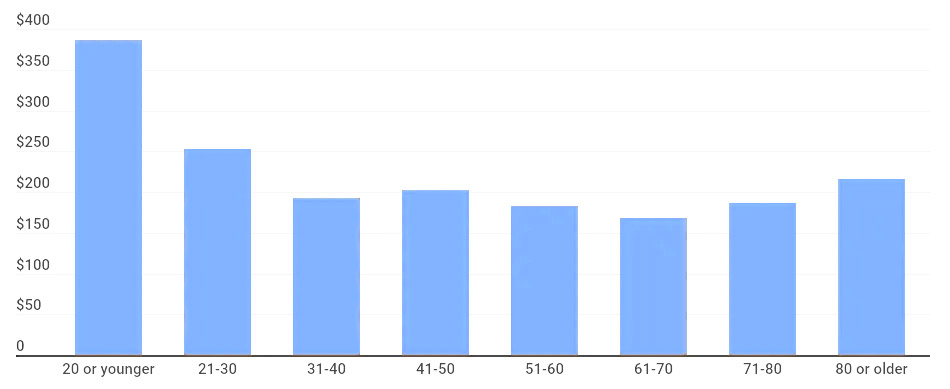

Age

Generally speaking, car insurance gets cheaper the older you get and the more experience you have until you’re over 70.

Average monthly car insurance rates by age

Your home

Bad news for renters — car insurance premiums are more expensive when your rent than when you own a home. Statistically, renters are more accident-prone (dang it!).

Marital status

Singles pay more. Research shows you have fewer car accidents if you are married. Car insurance quotes presented to married drivers on Insurify were about $14 less than those for single drivers.

Average monthly car insurance rates by state

Even if you have a clean driving record, your auto insurance rates can increase depending on where you live. Here’s a table of average monthly car insurance by state. (South Dakota and Wyoming share the prize for the lowest rates.)

| State | Monthly premium | Annual premium |

| Alabama car insurance | $54 | $648 |

| Alaska car insurance | $36 | $432 |

| Arizona car insurance | $67 | $804 |

| California car insurance | $86 | $1,032 |

| Colorado car insurance | $60 | $720 |

| Connecticut car insurance | $91 | $1,092 |

| Delaware car insurance | $85 | $1,020 |

| DC car insurance | $75 | $900 |

| Florida car insurance | $130 | $1,560 |

| Georgia car insurance | $72 | $864 |

| Hawaii car insurance | $55 | $660 |

| Idaho car insurance | $41 | $492 |

| Illinois car insurance | $58 | $696 |

| Indiana car insurance | $38 | $456 |

| Iowa car insurance | $32 | $384 |

| Kansas car insurance | $52 | $624 |

| Kentucky car insurance | $126 | $1,518 |

| Louisiana car insurance | $140 | $1,686 |

| Maine car insurance | $42 | $504 |

| Maryland car insurance | $82 | $984 |

| Massachusetts car insurance | $73 | $876 |

| Michigan car insurance | $208 | $2498 |

| Minnesota car insurance | $83 | $996 |

| Mississippi car insurance | $52 | $624 |

| Missouri car insurance | $62 | $744 |

| Montana car insurance | $49 | $588 |

| Nebraska car insurance | $41 | $492 |

| Nevada car insurance | $130 | $1559 |

| New Hampshire car insurance | $42 | $504 |

| New Jersey car insurance | $109 | $1,308 |

| New Mexico car insurance | $57 | $684 |

| New York car insurance | $94 | $1,128 |

| North Carolina car insurance | $57 | $684 |

| North Dakota car insurance | $37 | $444 |

| Ohio car insurance | $43 | $516 |

| Oklahoma car insurance | $58 | $696 |

| Oregon car insurance | $76 | $912 |

| Pennsylvania car insurance | $49 | $588 |

| Rhode Island car insurance | $114 | $1,368 |

| South Carolina car insurance | $61 | $732 |

| South Dakota car insurance | $28 | $336 |

| Tennessee car insurance | $52 | $624 |

| Texas car insurance | $66 | $792 |

| Utah car insurance | $80 | $960 |

| Vermont car insurance | $37 | $444 |

| Virginia car insurance | $46 | $552 |

| Washington car insurance | $58 | $696 |

| West Virginia car insurance | $50 | $600 |

| Wisconsin car insurance | $43 | $516 |

| Wyoming car insurance | $28 | $336 |

| National average renters insurance | $67 | $803 |

Compare car insurance quotes from top insurance providers

See all 200+ national and regional auto insurance companies here

Enter your zip code to see how much you can save.

Compare car insurance quotes in your state.

- Arizona Car Insurance

- California Car Insurance

- Colorado Car Insurance

- Florida Car Insurance

- Georgia Car Insurance

- Illinois Car Insurance

- Maryland Car Insurance

- Massachusetts Car Insurance

- Michigan Car Insurance

- Minnesota Car Insurance

- North Carolina Car Insurance

- New York Car Insurance

- Nevada Car Insurance

- Ohio Car Insurance

- Oregon Car Insurance

- Pennsylvania Car Insurance

- Texas Car Insurance

- Utah Car Insurance

- Washington Car Insurance

- Wisconsin Car Insurance