Our goal is to share information and products that are truly helpful to renters.

If you click on a link or buy a product from one of the partners on our site, we get paid a little bit for making the introduction. This means we might feature certain partners sooner, more frequently, or more prominently in our articles, but we’ll always make sure you have a good set of options. This is how we are able to provide you with the content and features for free. Our partners cannot pay us to guarantee favorable reviews of their products or services — and our opinions and advice are our own based on research and input from renters like you. Here is a list of our partners.

How to pay off debt

Understanding debt and strategies to pay it off

It’s all too easy to rack up debt — a dinner here, concert tickets, student loans, travel, medical expenses, and more. In fact, research shows for the average American, personal debt climbs higher with each decade. It doesn’t have to be this way — with strategy and a bit of discipline, you can pay off debt faster than you might think.

What is debt?

The simple definition is anything owed to someone else is considered debt like the following:

- credit cards

- car loans

- payday loans

- personal loans

- student loans

- medical debt

- IRS and government debt

This is separate from your monthly expenses — for example, your ongoing bills like rent, groceries, electricity, water, and utilities.

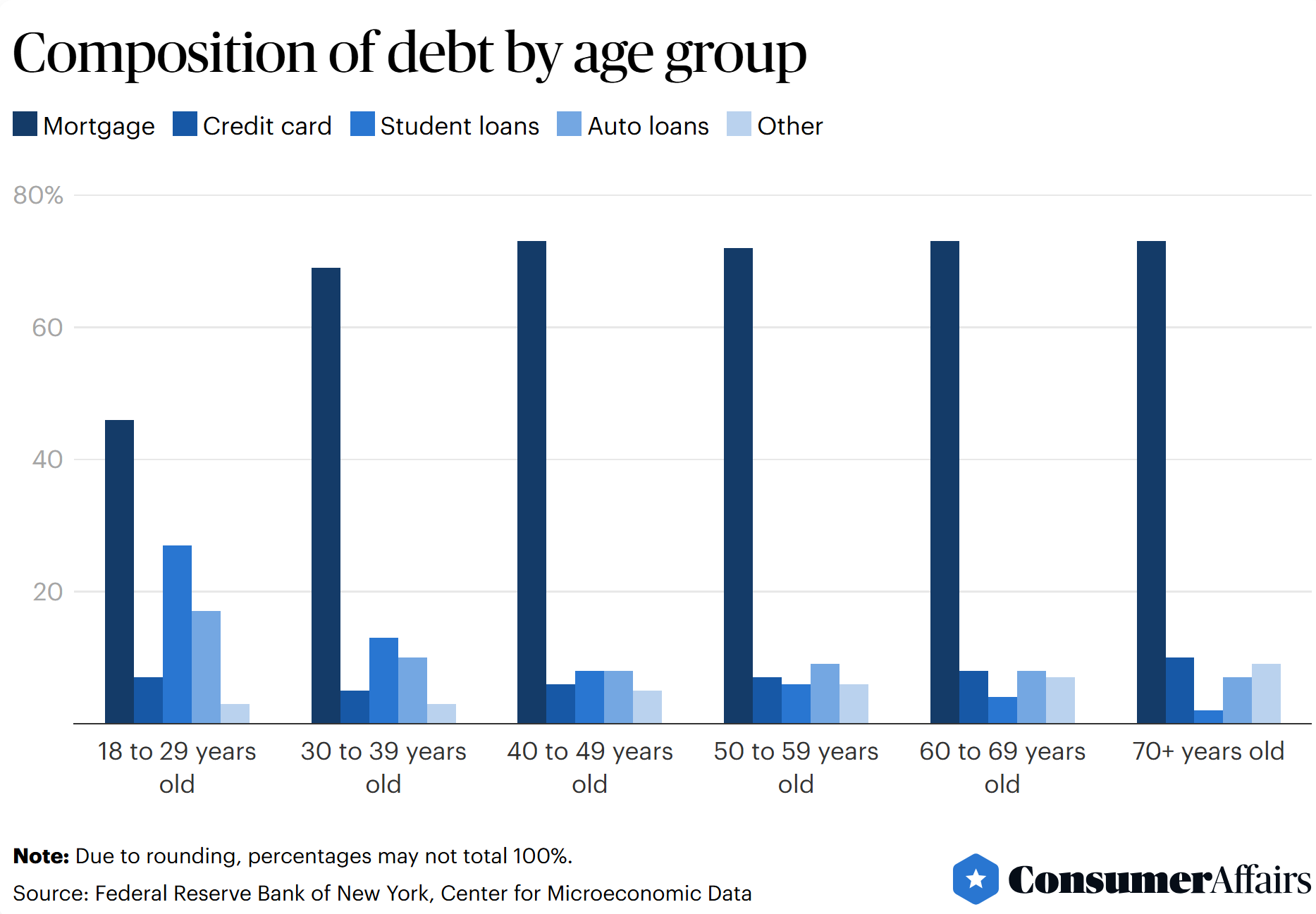

Average debt balance by age group

Americans are spending thousands of dollars paying interest and research shows it increases as you age.

It doesn’t have to be this way with a good budgeting approach and debt payoff strategy.

Strategies to pay off debt

The Snowball Method

Pay off your smallest debt first (while paying minimums on the others). Once the smallest debt is paid off, roll that amount forward to the next smallest debt and repeat.

The Avalanche Method

Pay off your debt with the highest interest rate first (while paying minimums on the others). Once the debt with the highest interest rate is paid off, roll that amount forward to tackle the next highest interest rate.

Debt consolidation

Consolidate high-interest credit card debt into one lower-interest personal loan. This makes payments more manageable and hopefully, the payoff period is shorter.

Debt management plan or personal bankruptcy

If you’re facing a mountain of credit card debt and not making much progress, a nonprofit credit counseling agency can set up a debt management plan to cut your interest rate and put you on a repayment plan.

Alternatively, explore Chapter 7 or 13 bankruptcy as well. It may make more sense for you in the long run.

Debt-paying tactics to support your strategy

Update your budget

According to debt.com about 66% of Americans say they maintain a monthly budget. The superstar budgeting award goes to the 23-38-year-olds — with heavy use of budgeting apps like Mint and programs that automate the process.

Many of the apps can help you identify overspending and areas to cut back. As well as help you set goals for savings and paying down debt. As the saying goes, “you get what you measure.”

Keep spending in check and/or reduce expenses

As part of your budgeting process, take a look at your monthly purchases, and try categorizing them into different areas.

See where you can cut back to save a little extra each month to increase a debt payment.

And, if you’re willing to spend some time calling or chatting with your cable provider or phone company, chances are good that you can leverage your loyalty as a customer to negotiate a lower monthly price.

Read 5 steps to negotiate lower monthly bills for extra tips.

Get a side gig or sell something for extra cash

Cutting back expenses is not the only way to get ahead (and sometimes it’s not realistic), so try earning a little extra on the side.

From selling your gift cards for cash to starting a blog, there are lots of legitimate ways to earn a small amount of money quickly.

You can get debt-free

Having debt is not always bad — and a little can help you build your credit. But large amounts of it are a financial burden. Even if you can meet your minimum payments, interest rates add up — and over the years your personal balance increases — sabotaging your savings and retirement goals.

Getting out of debt is a process and starting is the most important decision to make. Make a budget, identify your debts and spending habits, then create a plan. And, remember with each payment, your one step closer to your goal!

Your renters rights, in your state.

Explore what you need to know.

- Alabama Renters Rights

- Alaska Renters Rights

- Arizona Renters Rights

- Arkansas Renters Rights

- California Renters Rights

- Colorado Renters Rights

- Connecticut Renters Rights

- Delaware Renters Rights

- Florida Renters Rights

- Georgia Renters Rights

- Hawaii Renters Rights

- Idaho Renters Rights

- Illinois Renters Rights

- Indiana Renters Rights

- Iowa Renters Rights

- Kansas Renters Rights

- Kentucky Renters Rights

- Louisiana Renters Rights

- Maine Renters Rights

- Maryland Renters Rights

- Massachusetts Renters Rights

- Michigan Renters Rights

- Minnesota Renters Rights

- Mississippi Renters Rights

- Missouri Renters Rights

- Montana Renters Rights

- Nebraska Renters Rights

- Nevada Renters Rights

- New Hampshire Renters Rights

- New Jersey Renters Rights

- New Mexico Renters Rights

- New York Renters Rights

- North Carolina Renters Rights

- North Dakota Renters Rights

- Ohio Renters Rights

- Oklahoma Renters Rights

- Oregon Renters Rights

- Pennsylvania Renters Rights

- Rhode Island Renters Rights

- South Carolina Renters Rights

- South Dakota Renters Rights

- Tennessee Renters Rights

- Texas Renters Rights

- Utah Renters Rights

- Vermont Renters Rights

- Virginia Renters Rights

- Washington Renters Rights

- West Virginia Renters Rights

- Wisconsin Renters Rights

- Wyoming Renters Rights

- Washington, D.C. Renters Rights

Advertising disclosure