WHY DEPOSIT AUTOMATION

Traditional cash deposits

aren’t going away

Most renters prefer refundable security deposits. They understand how they work and find them less costly than paying another non-refundable, monthly bill. Not to mention, all jurisdictions require them in some form.

Calculate ROIWHY DEPOSIT AUTOMATION

Traditional cash deposits

aren’t going away

Most renters prefer refundable security deposits. They understand how they work and find them less costly than paying another non-refundable, monthly bill. Not to mention, all jurisdictions require them in some form.

Calculate ROI

WHY DEPOSIT AUTOMATION

Traditional cash deposits

aren’t going away

Most renters prefer refundable security deposits. They understand how they work and find them less costly than paying another non-refundable, monthly bill. Not to mention, nearly all jurisdictions require them in some form.

Calculate ROI

Proven time & cost savings

100%

less time mailing refund checks & account statements

30%

less time on uncashed checks & unclaimed property

70%

less time responding to renter refund inquiries & changes

45%

faster refunds back to residents & their roommates

Centralize, reduce cost, and scale up

Free your accounting team from refunds

Save your site and accounting teams hundreds of hours. Outsource repetitive deposit management tasks to Roost so your team can focus on the business and resident experience instead.

Ensure jurisdictional compliance

Jurisdictional compliance is increasingly challenging. Roost turns high-risk, people-dependent workflows into an automated process to reduce the risk of fines.

Modernize and streamline your refund process

Whether your jurisdiction requires paper refund checks or residents can opt for direct deposit, Roost centralizes and automates all payment collection and refund issuance on your behalf.

Built in reminders improve forwarding address capture, resident refund check cashing and more. Spend less time managing returns and unclaimed property.

Guard against security deposit fraud

- Greater visibility of security deposit payments and refunds

- Audit logs and reporting

- Separation of duties

- Smart notifications and compliance alerts

- Identity verification and secure payment transfers

- Account balance verification and NSF protection built in

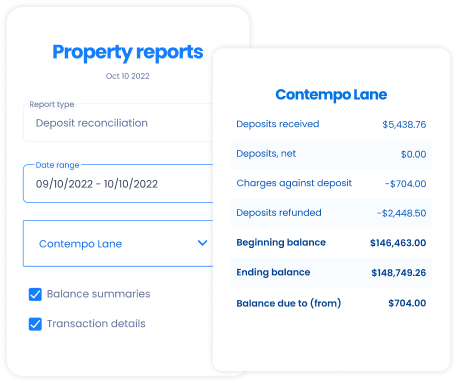

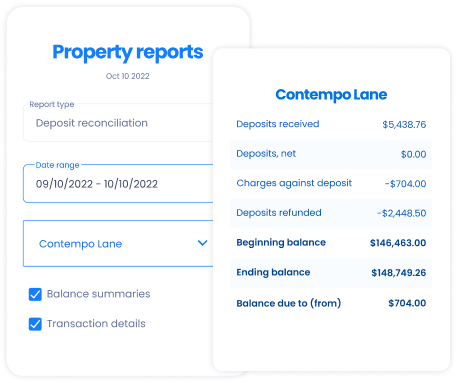

Faster, simplified accounting

Total visibility for greater control

Your PMS remains the system of record and all transactions post back to the general ledger. You’ll have the context you need to manage all transactions.

Easier month-ends

Eliminate manual work with Roost online deposit reconciliation. Detailed security deposit payments, refunds, beginning and ending operating balances are available online. Export and go.

Less bad debt and a better resident experience

Security deposit automation provides residents with the transparency, rewards and incentive to take care of their unit and get a full refund.

With fewer damages, you’ll reduce final account balances and bad debt. You’ll also prevent unpleasant surprises for residents and negative reviews for your property—residents know exactly how much refund they’re getting back and why.