Our goal is to share information and products that are truly helpful to renters.

If you click on a link or buy a product from one of the partners on our site, we get paid a little bit for making the introduction. This means we might feature certain partners sooner, more frequently, or more prominently in our articles, but we’ll always make sure you have a good set of options. This is how we are able to provide you with the content and features for free. Our partners cannot pay us to guarantee favorable reviews of their products or services — and our opinions and advice are our own based on research and input from renters like you. Here is a list of our partners.

Roost survey: Financial amenities and services

Roost recently surveyed renters about what types of financial amenities and services they use and value most. Our goal was to understand which property-sponsored amenities were currently offered compared to those that renters really want. What we found: Few properties actually offer these services but doing so may influence where an applicant applies, if an existing resident renews their lease, and whether or not they leave a positive or negative review.

Renters feel financially vulnerable

To kick off our survey, we asked renters to share how they felt about their current financial situation. Nearly 51 percent of all renters felt financially vulnerable, 39.7 percent said they were doing ok or coping, and just 9.5 percent reported feeling financially healthy.

With six million renter households behind on their rent payments, it’s no surprise that renters are feeling financially vulnerable. It’s also no surprise that financial wellness is a top concern—nearly 90% of those surveyed said that maintaining or improving their financial health is very important to them.

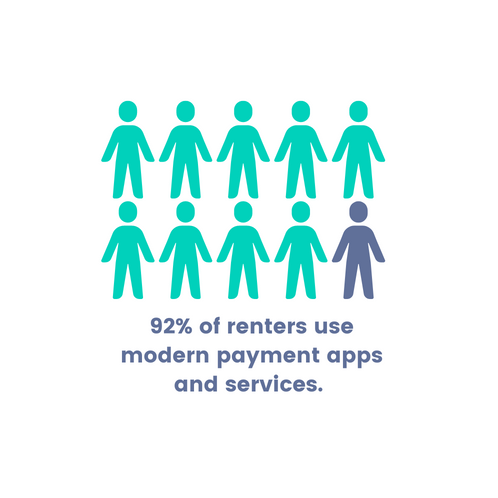

Nearly all renters use digital payment apps

Survey respondents are accustomed to using modern payment apps and services. Ninety-two percent use digital payment apps like Venmo or Paypal and nearly 50% use ApplePay, Google Pay, or Samsung pay. More than 25% reported using BNPL (Buy Now Pay Later), a service that lets consumers spread out the cost of purchases and smooth out cash flow.

Renter financial amenities are not widespread but should be

We asked respondents if their landlord or property manager offered certain financial amenities at both move-in and move-out. Thirty-six percent reported that none of the listed services were offered at move-in, and nearly 58% percent said none of the move-out services were available to them.

However, respondents indicated that if offered, many amenities would make them more likely to apply to a particular property or renew their lease. For example, 63% said that earning interest on their security deposit would make them much more likely to apply.

Which financial amenities attract new residents & build loyalty

Security deposit payment plans

Sixty-eight percent of respondents reported they’d be more likely or much more likely to apply if deposit payment plans (installment plans) were offered, but just less than 4% reported that the service was available to them. With more states requiring installment plans, we expect availability to increase.

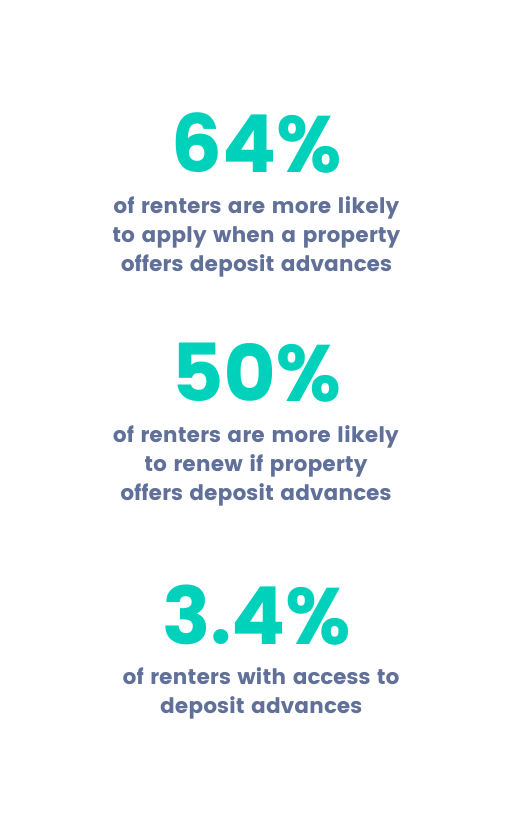

Deposit advances

If provided with a deposit advance service, nearly 64% of respondents said they’d be more likely or much more likely to apply and more than 50% were more likely to renew their lease. (Deposit advances give residents access to a portion of their refundable deposit money during their lease. It’s essentially an instant emergency fund.) However, very few properties appear to offer this service: only 3.4% had access to deposit advances.

Earning interest

Sixty-three percent of renters said that earning interest on their refundable deposits would make them much more likely to apply at one property over another, but very few actually had access to this benefit.

Flexible rent payments

The majority of renters—58%—would be much more likely to apply for an apartment at a property that offered flexible rent payments (i.e. a flexible rent due date), but the service was not yet widespread. Nearly 33%, however, reported that their property accepted rent payments by credit card.

Rent reporting to build credit history

Finally, 11% of renters currently enjoy having their rent payments reported to credit bureaus to help their credit histories but significantly more want the service. An average of 41 percent indicated that they’d be much more likely to apply or renew their lease if rent reporting were offered.

Rewards for future home purchase

More than 59% of renters said that some form of rewards or rebates towards a future home purchase would highly influence where they applied or if they renewed their lease, yet none of the respondents reported living at a property where this kind of amenity was offered.

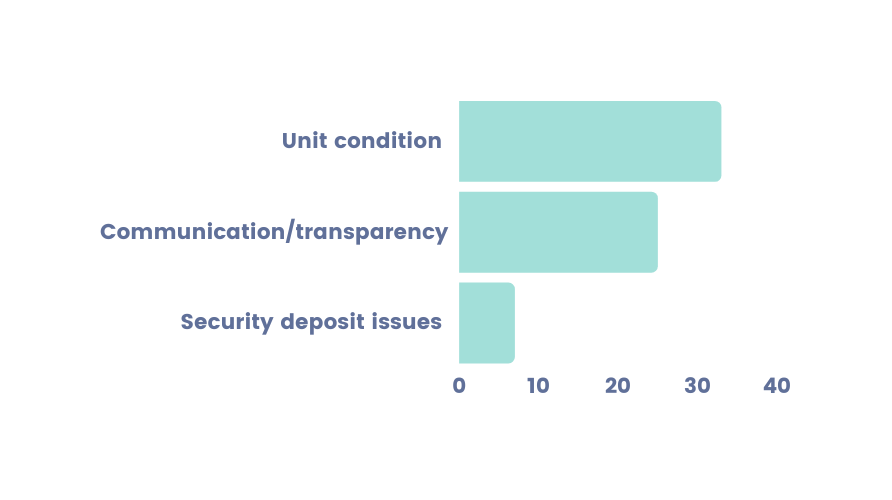

Renter online reviews: transparency matters

The good news? Thirty-three percent had left a review giving their property team kudos. The bad news? Twenty-five percent had left a negative review due to a lack of communication and transparency. Seven percent also reported leaving a negative review due to security deposit damage charge issues. These findings indicate that many properties can improve reviews and retention with better transparency.

Properties should offer more financial amenities

The Roost survey indicated that the majority of residents feel financially vulnerable, want to improve their financial health, and are interested in property-sponsored financial perks and amenities. The survey also found that offering some of these services may influence where an applicant applies, if a resident renews their lease, and whether or not they leave a positive or negative review.

For more information on the impact of offering financial service amenities to renters, check out our webinar on “Why improving renter financial health is good for residents & NOI”.