Financial health research

According to the Financial Health Network, only 28% of Americans are considered financially “healthy”. That means the majority of your residents will struggle at some point during their lease. Here’s why.

Financial stability is hard

no matter how much you make

Americans across all income classes struggle with money. Rising student debt, medical costs and living expenses—including a median 17.8% rent increase in 2021—can impact the financial health of even the best budgeters.

Emergency funds are difficult to build

When you’re living paycheck-to-paycheck, it’s difficult to set aside extra money each month. When an unexpected expense arises—a medical bill, car repair, last minute childcare—you have nowhere to turn.

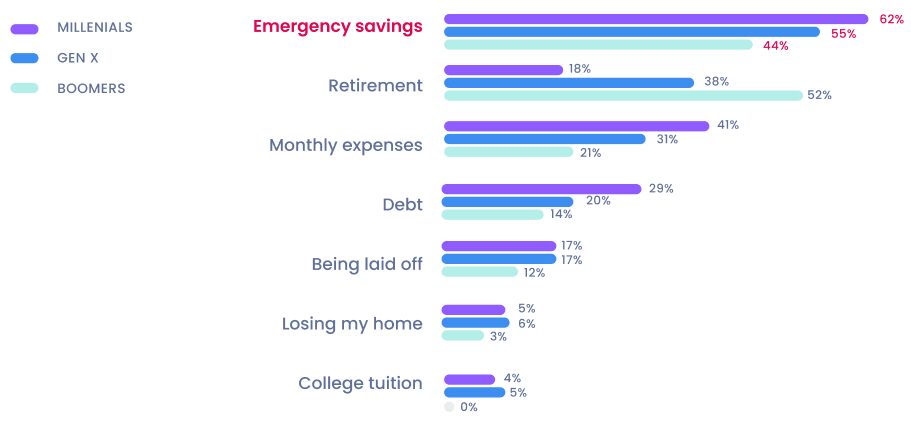

Building savings

is on residents’ minds

Consistent with prior years, emergency savings is the most frequently cited financial concern for Millennial and Gen X employees.

Source: PwC

What are your top financial concerns?

(up to 2 answers allowed per employee)

American adults today

Source: Financial Health Network

28%

Healthy

70 million people

These individuals are spending, saving, borrowing & planning in a financially healthy way.

55%

Coping

138 million people

They’re struggling with some, but not necessarlly all, aspects of their financial lives.

17%

Vulnerable

42 million people

These individuals are struggling with all, or nearly all, aspects of their financial lives.

Research from the experts

Financial Health Pulse 2021

2021

Discover how Americans’ financial health outcomes have changed as COVID-19 continued to create unprecedented disruptions. – Financial Health Network

Perceived Financial Preparedness, Saving Habits, and Financial Security

September, 2020

How people feel about their financial preparedness and if they’re prepared to deal with financial emergencies as they arise. – Consumer Financial Protection Bureau

Short-term financial stability: A foundation for security and well being

April, 2019

Why short-term financial stability plays a central role in reaching broader financial security and upward economic mobility. – The Aspen Institute